Even if we don’t see it or think about it often, a credit score is an essential part of our lives. It’s a very important financial measure as it is used by a variety of businesses to assess the risk you pose. Lenders use this score to decide whether to give a loan and what terms to offer. A bad credit score could result in much higher interest rates. Utility or mobile phone companies may use your score to decide what kind of deposit will be required when doing business with you. Landlords may use credit scores when deciding whether or not to rent to someone, and employers sometimes check the credit history of job applicants.

Because credit scores have become an essential part of our lives, you should understand how they impact your life. One of the first things to know is that there is not just one credit score, but many. Also, different financial institutions and credit scoring agencies have created their own scoring models.

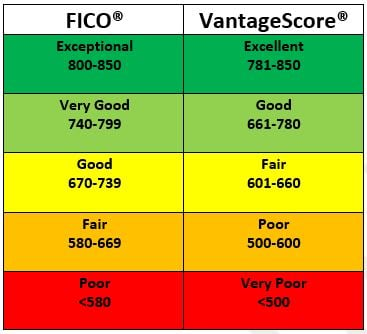

The two most widely-used credit scoring models are FICO and VantageScore . These two scoring models both currently have a scoring range from 300 to 850.

FICO® and VantageScore® Ranges

Higher scores generally represent lower credit risk and can make creditors have greater confidence that you will be able to repay your future debts as agreed. Lower scores can reflect a higher credit risk and can make creditors have less confidence that you will be able to repay your future debts as agreed and as a result may increase the annual percentage rate (“APR”) offered to offset the increased risk.

What is a Bad Credit Score?

A bad credit score can be likened to a bad grade in school, a failing grade on a driving test, or getting bad results for any other type of numerical assessment that judges performance. Discovering that your credit score might be less than you thought may be discouraging, but fear not as you are not stuck with your bad credit score forever. Making improvements to a few key credit habits can see your score increase over time.

You can notice in the credit range provided that there is not an actual range for “bad”. Each lender makes their own assessment of scores deemed to be risky.

Don't be Discouraged if You Have Bad Credit

If you have bad credit, it is possible for you to repair it. Two of the best ways to repair your credit is to ensure you pay your bills on time and start paying down your debt. It may take time to pay down your debt but it will be worth your time and effort. Improving your credit should make your financial life easier by helping you save money on loans and credit cards.

Do You Know Your Credit Score?

It is important to obtain and review your credit reports once a year. By doing this you can find ways to improve your score. It is also important to review your credit reports to ensure you have not been a victim of identity theft or of errors on your report.

Checking your credit score will not lower it. You are entitled to a free copy of your credit report from each of the three major credit bureaus every 12 months. One of the easiest ways to do this is by visiting www.annualcreditreport.com. Also, many credit card issuers provide your credit score as a free service.

During the COVID-19 pandemic, the three national credit bureaus, TransUnion, Experian, and Equifax, are offering all U.S. consumers free weekly online credit reports through April 20, 2021.

Why You Should Check Your Credit Score

It’s always good to check your credit score on a regular basis, especially if it is really low. Let’s look at some reasons why it’s important to check your score:

-

- Provides you a sense of your current financial fitness by providing a numerical grade of the contents of your credit reports.

- You won’t be surprised at the outcome of any loan and credit card applications.

- You can respond to changes quickly.

- Identify when you might qualify for better credit offers.

- Idenfity any errors in your report.

Finally, it’s necessary to know that almost everyone has room to improve their credit score. Plus, a better credit score could mean possibly saving thousands of dollars per year in interest payments. And, monitoring your score doesn’t have to cost you a dime or much of your time.

.png?width=144&height=134&name=2019_PCI_Logo_Footer_10_16_19%20(002).png)